Textile Theme is on the way must hold

Textile sector can be broadly categorized into jute, sericulture, wool & woolen, man-made fiber & filament yarn industry. The Indian textiles industry contributes substantially to India�s exports earnings. The export basket consists of wide range of items containing cotton yarn and fabrics, man-made yarn and fabrics, wool and silk fabrics, made-ups and variety of garments. The major competitors for the Indian textile industry are China, Vietnam, and Bangladesh. USA is the single largest importer of textiles & clothing items. The rupee vis-�-vis dollar movement does have an impact on export of the textile industry. A 100% FDI is allowed in the textile sector under the automatic route. Textile Upgradation Fund scheme provides an option to the power loom units to avail of 20% Margin Money subsidy in lieu of 5% interest reimbursement on investment in TUF compatible machinery. Under the Scheme for Integrated Textiles Park (SITP), thirty nine (39) textile park projects have been approved so farRSWM LTD CMP 330 as on 23/7/2015

Introduction

RSWM, incorporated in 1960 as Rajasthan Spinning & Weaving Mills, has business interests in areas of yarn, fabrics, garments and denim. It is one of the largest producers and exporters of polyester viscose blended yarn in the country. RSWM has built one of the most impressive textile manufacturing infrastructures in the country -- 8 state-of-the-art manufacturing plants; 360.000 spindle machines; 176 looms: 100,000 MTA yarn capacity: 35.6 MMA fabric capacity, including denim fabric. The company is part of the LNJ Bhilwara Group. RSWM markets its products under the brand name Mayur Suitings for which it roped in Salman Khan as its brand ambassador.

RSWM possesses strengths and expertise to deliver Indias largest quantities of grey, dyed and melange yarn, while specializing in technical fabric. It is equipped with in-house fabric weaving and processing facilities, with an installed capacity of 12 million metres per annum. Modern technologies and world-class skills have enabled the company to produce the finest quality adhering to stringent international norms. The company has a state-of-the-art garment unit for global customers with a capacity to deliver 13,000 units daily. RSWN also operates 46 MW Captive Thermal Power Plant at Mordi

The company acquired 50% equity stake in SISA SA, Spain that has enhances its presence in higher value added international yarn market.

RSWM exports a complete range of yarn, fabric and garments to over 60 countries across Europe, South Africa, Australia, Korea, Belgium, Singapore, Italy, Egypt and the Gulf countries. With nearly 50% of RSWM's production exported, the company has a significant presence in the world of textiles.

The compnay has also been recognised as a Golden Trading House by the Government of India, having won the prestigious SRTEPC Export Award for several consecutive years.

RSWM set up a 100% subsidiary under the name RSWM International BV Holland. The company also acquired a Bengaluru based textile unit -- Cheslind Textile.

Awards and Recognition

RSWM was felicitated with the Rajiv Gandhi National Quality Award.

RSWM received the Niryat Shree award-Certificate of Excellence in the Textile and Textile Products (non-SSI) category for the year 2005-2006.

RSWM's Rishabhdev unit bagged National Export Award. The unit also bagged SRTEPC Excellence award for highest production in export of 100% Polyester spun yarn.

RSWM won the 2007 Excellence Award for Financial Performance and Analysis by Rajasthan Chamber of Commerce and Industry, Jaipur.

Future Plans

RSWM expects to improve in all its existing businesses, especially due to reduction in the cost of energy with the thermal power plant. Equally, it expects its technologically modern and scaled-up operations to contribute more significantly to the company's performance in the future

(taken from source**)

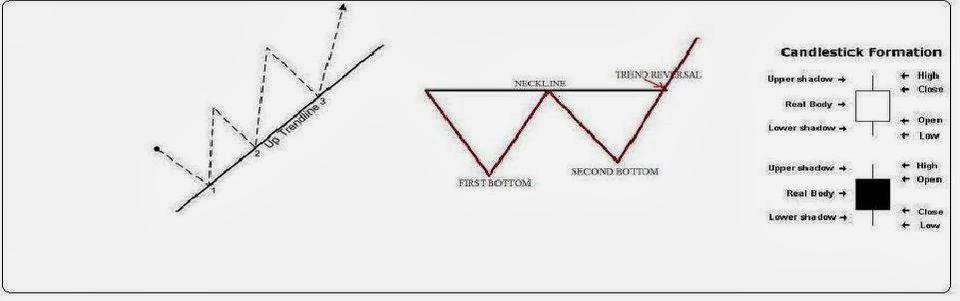

TECHNICAL HIGHLIGHTER

1.Ascending triangle break out on weekly chart .(bullish pattern )2.Multi year Break out ( 1st top 1994, 2nd top 2007 ,3 rd at 2014)

3.Fits in to my system of multibagger (weakly closing above 50 day Exponential moving average )

4. Volume is with trend .

How to execute ??

1.Buy 20-25% of allocated amount at CMP 330 .

2. Next support zone is 233 so allocate 30-50% if it comes .

Target price

1.Minimum target price is 525 ( arrived from ascending triangle ).

2.Investor must also keep in mind that it has come out from multi year top , so it may be in its bull run at least for 10 year from 2015 . Deriving at accurate target is not healthy discussion , rather one may use 50 day EMA as trailing stop loss , so that Investor may take maximum advantage .

Financials

Industry PE: 18.04 | Industry Price to BV: 1.43

Stock P/E: 7.51

Market Cap: 750.99 Crores

Current Price: 330

Book Value: 213.44

Profit and Loss

- There is steady increase in Sales , Net profit and EPS

1. Increase in reserve

2. Decrease in unsecured loan

Cash flow

1. Increase in cash from operation

(Financial taken from screener .in )

Disclosure :- I own this stock .